- Resources

- Law Firm Billing Considerations: Save Time & Get Paid

Table of Contents

Ah, billing.

That magical time when you get to charge a client for your work and get paid. Billing might not invoke feelings of excitement or give you an adrenaline rush, but it is obviously very important. After all, without billing, you don’t get paid.

Law firms charge clients for work performed through their billing policy. However, even though law firm billing is critical to the firm’s operations, it’s often seen as an annoying task through a lawyer’s eyes.

Even though billing is a necessary part of any lawyer’s day, the amount of work that goes into billing can take more time out of a typical day than would be ideal. Lawyers want to practice the law, and not spend more time than necessary with billing-related tasks.

Advancements in legal tech mean that the legal technology law firm is adopting solutions to help streamline their pricing and law firm billing procedures. Technology like artificial intelligence is helping future-focused firms increase their realization and collection rates through quicker and more accurate invoice creation, better law firm billing processes, and more.

Challenges with Law Firm Billing

Unfortunately, law firm billing is wrought with challenges. While these challenges are diverse, they all center around clients who do not pay invoices on time. Unpaid invoices cause issues with book balancing and accounting, and frustration among legal professionals as they struggle to build their own individual processes due to an inadequate firm-wide billing system.

It’s not that clients don’t want to pay their legal bills, but issues with sticker shock and inefficient billing processes that result in bills being sent out too late or forgotten about are major reasons why legal bills aren’t getting paid.

Collections

Under the traditional hourly billing model, clients are often surprised by the final bill amount, which in turn causes issues with receiving payments. Lawyers usually resort to negotiations, but those aren’t always fruitful, and bills still end up in collections.

Collection rates are one of the key metrics used to evaluate law firm performance. It’s a measure of a lawyer’s hard work transferring to revenue for a law firm.

One of the key areas that have been proven to help increase client payments is payment convenience. If it’s easy to pay a bill, you’re more likely to pay it. That’s just common sense. Another factor is AFAs or alternative fee arrangements, which provide price certainty for clients to eliminate sticker shock.

Growing evidence shows significant revenue growth for law firms that adopt an AFA pricing model, such as with DL&Co, which increased their collected-to-billed fees ratio by over 7% by switching to AFAs. And it makes sense: when consumers know how much a bill will be before they agree to a service, they’ll be more inclined to pay it

Decreasing the potential for a bill to be sent to collections benefits the law firm and the client, which is one of the major reasons why more and more law firms are exploring alternative pricing.

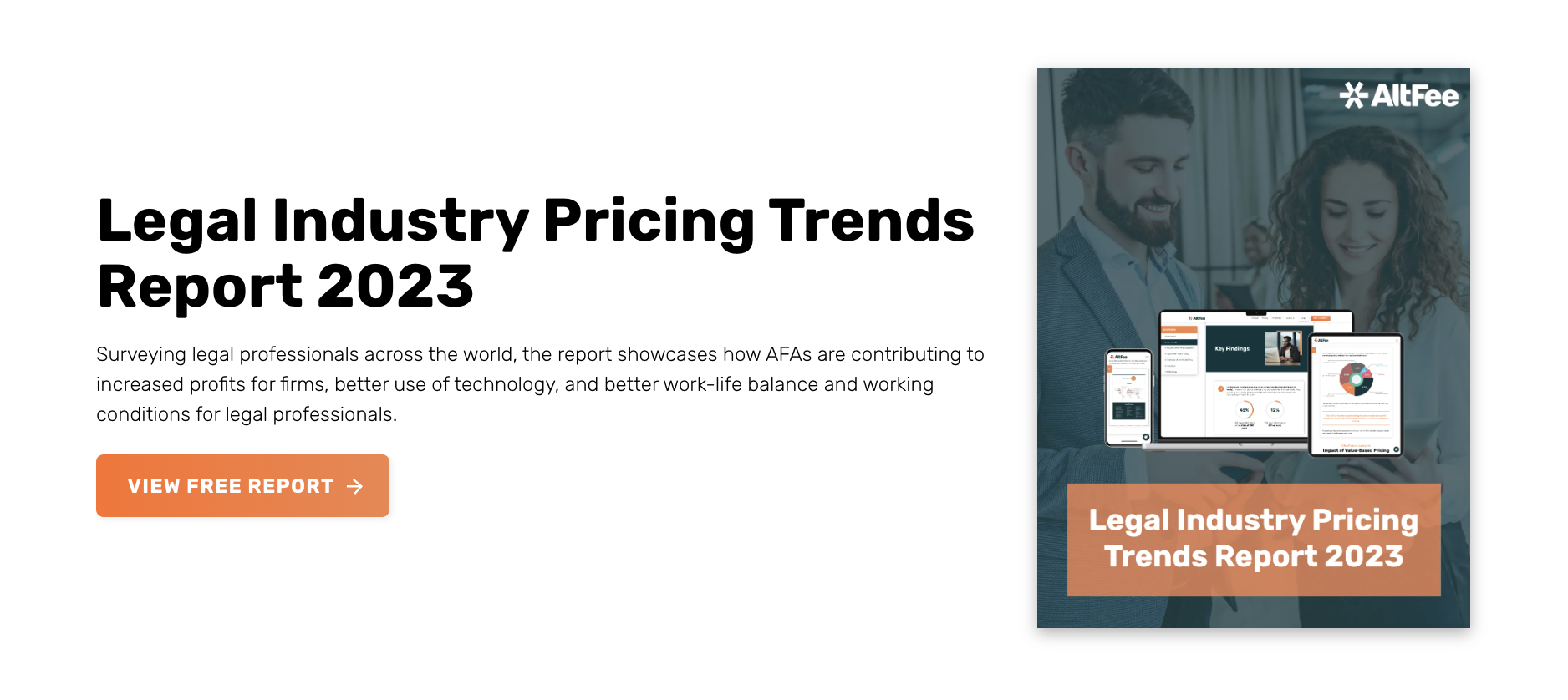

Discover why the use of AFAs in the legal industry is rapidly increasing in AltFee’s Legal Industry Pricing Report:

Too Much Administrative Work vs. Legal Work

Even though lawyers don’t like to do it, administrative work is an inevitable part of the job. Obviously, there are tools out there that can help with this work, such as law firm time and billing software, but you have to consider how this tool fits in with your current billing process, and what improvements could bring.

For instance, let’s say one of the most time-consuming administrative tasks your lawyers face is invoice creation. It requires them to correctly reconcile the time spent on a legal matter with any existing fee arrangements, including the scope of work adjustments, flat fee billing, and more. With so much data needing to be gathered and calculated, it’s no wonder that average realization rates are still lower than they should be.

There are a few ways that law firm billing can be improved using AltFee’s software:

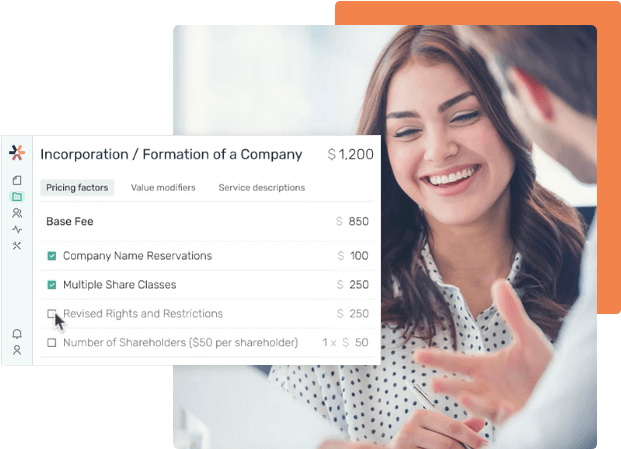

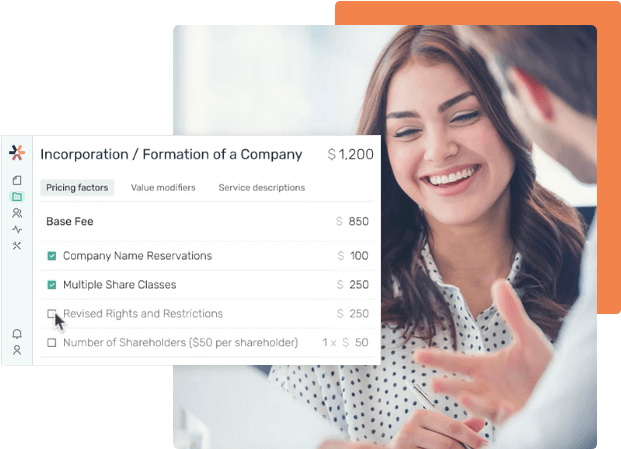

- First, if you don’t already use alternative fee arrangements, it’s absolutely time to make the switch. When you have clear pricing models for different legal services that don’t focus on time tracking, it’s so much easier to create a bill. Consider this: software that lets you collaborate with other legal professionals to set out the best pricing for a particular service, and itemize each billable task with a price attached. You can accomplish all of this with AltFee.

- Once you’ve done that, you can save your work as a template and use it as a starting point for pricing the services for future clients looking for similar services. Internal stakeholders can also leave comments and feedback as necessary.

- When a final bill is ready for a client, it’s easy to export and send digitally to the client in any way you wish. This helps keep realization rates in check and helps keep bills sent in a timely manner.

- Finally, you can use law firm billing and matter management software (such as Rocket Matter or Clio) to reconcile your price sheet, time tracking (if applicable), timeline and scope changes (if applicable), and more to create a final bill.

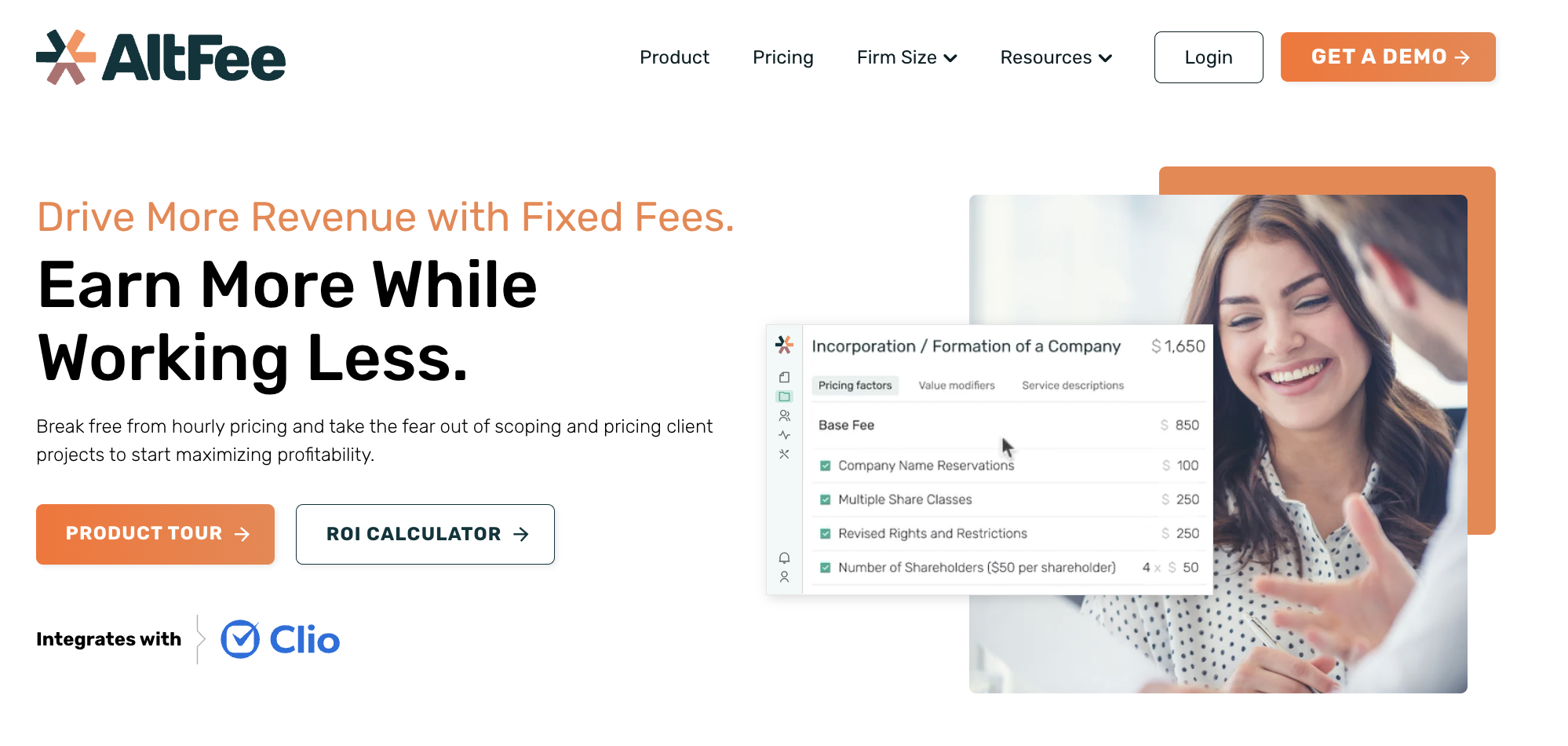

Start Earning More Revenue with Fixed Fees

Break free from hourly pricing and take the fear out of scoping and pricing client projects to start maximizing profitability.

Book A Demo

An Inefficient or Unclear Billing Process

We’ve discussed how to create a streamlined law firm billing process in previous sections of this article, and that’s because an inefficient or unclear billing process can cause many problems with receiving payments at your law firm. When lawyers and legal professionals at your firm don’t understand or can’t make sense of your firm’s billing process, it’s likely that they’ll bypass it and just create their own. After all, clients need to get billed, and lawyers need to get paid. What this creates is inconsistencies with billing, since one client might get a completely different bill with one lawyer compared to another. Even if your lawyers try to follow your unclear billing process, there are likely to still be inconsistencies with how they interpret each step.

That’s why written law firm billing guidelines and policies are so important. If you follow the steps outlined in the previous section on law firm billing guidelines and policies, you can start creating a billing guideline immediately.

Poor Time Management

If lawyers are spending big chunks of their day handling bills, then it begs the question, “Are they spending their time effectively?”

If you ask the lawyers directly, the answer will likely be no. After all, they got into the legal profession to practice the law, not spend time with administrative tasks like billing. If you’re using alternative pricing for your law firm already, chances are that the problem with time management lies mostly in your billing process. These days, law firm billing software can automate a lot of your billing tasks, and even provide a platform for you to accept payments from clients. This means no more checks or processing of credit cards over the phone. Instead, you can accept online payments. Sure, it might cost a bit extra since the payment provider always charges the business a percentage for every payment, but it’s definitely worth it to give your clients the convenience they expect.

If you’re still using the traditional billable hour, then the more efficient your law firm becomes, the more the billable hour becomes unsustainable. It’s no secret that many lawyers who still work on an hourly basis work many more hours than they actually bill out to a client, so that would need to be the first thing you should address. Good time tracking software can help, but it’s always a good idea to consider switching to alternative fee arrangements, if not to propel your law firm into the future but to save the sanity of your lawyers and clients.

How AI Helps With Law Firm Billing Policy

In addition to pricing software like AltFee, there are also current technologies like AI to consider. Legal AI tools in the legal industry are used for efficiency gains. One of the biggest features of AI that’s useful to law firms is the ability to intake vast amounts of data and glean insights from it.

Increased efficiency through AI could be applied to anything from reducing general administrative workload to, you guessed it, streamlining billing.

Here are some essential ways that AI can assist with a law firm’s billing process:

Consistent Enforcement of Billing Guidelines

Even though law firm billing guidelines should be easy to understand, that doesn’t mean they won’t be complex. There are so many different aspects of billing to consider, such as individualized payment plans, local and federal or state/provincial legislation, e-billing versus paper, and more. Even the most dedicated rule-following employee likely won’t be able to cite your firm’s billing guidelines word for word, meaning that some oversight is likely to happen.

Inconsistencies with billing can lead to all sorts of trouble, affecting a firm’s reputation in the eyes of regulatory bodies and clients. AI can provide intelligent invoice review, with the ability to identify law firm billing guideline violations and notify the lawyer of any errors before the invoice is sent to the client. Through algorithms, Legal AI is able to encourage better compliance and drive billing process improvement.

Improved Efficiency and Cost Savings

Instead of having to manually pour over every invoice, AI algorithms can make the jobs of legal and claims specialists easier by providing them with much-needed information that they can use to improve the billing process, while spending less time on the task itself. Estimated cost savings when a law firm incorporates AI into their legal bill review process can be up to 10%.

Build Stronger Relationships with Clients

Law firms are always focused on making their clients happy and increasing their satisfaction with the legal services that the firm provides. The 2022 Legal Trends Report by Clio highlights how clients want price certainty with their legal services through having the choice of a range of billing options, with the majority of surveyed clients preferring flat fees.

When a law firm can provide consistent pricing and billing across all the services they provide, it helps build trust and credibility with the clients they serve.

Upfront Pricing in the Legal Field and Why it’s Gaining Traction

Consumer behavior has changed drastically over time, with people demanding transparency and price certainty with all goods and services they consume, and legal services are no different.

Many law firms have already embraced alternative fee arrangements to provide the pricing certainty clients are looking for, adopting pricing models like fixed fees over the traditional billing model. This means that upfront pricing is more common in law firms in general, with some even listing their base pricing for some services directly on their website.

So why is this happening now?

If we break it down, two major factors drive upfront pricing in law firms:

- Lawyer burnout and increased pressure on firms to provide better work-life balance. The IBA Young Lawyer’s Report, which surveyed 3,000 young lawyers from around the world (young lawyers are defined as 40 and under in the report), revealed that more than half of them were likely to move to a new workplace, and 33% wanted to switch to a different area of the legal profession, and 20% were considering leaving the profession entirely. And stats like this aren’t isolated to this report. The 2022 State of the Legal Market report indicates that some law firms risk losing up to 125% of their workforce over the next five years. Stats like these have caused law firms to seriously consider their work culture and how they can provide better working conditions for their legal professionals.

- Legal technology driving efficiency in law firms. The adoption of legal technology solutions like AI has made law firms more efficient, and efficiency kills the billable hour. Much like having a computer at home with the internet is essential, firms can’t simply ignore technology and be successful. But with more tech in the legal industry, firms need to figure out how to price their services that rely on value rather than efficiency.

It’s clear that the way law firms approach pricing will be a major determinant of their success now and in the future.

Forming Progressive Law Firm Billing Guidelines & Policies

Time is of the essence all the way through a client’s matter, but when it comes to paying the final bill, suddenly, things are at a standstill. It’s a frustrating feeling for both the lawyer and the law firm, as now the arduous process of chasing the money begins.

If this scenario sounds familiar to you, then you need clear billing guidelines and policies in place to help prevent it.

Your law firm’s billing guidelines and policies are meant to set out expectations for how lawyers reconcile billing for clients, and make the overall process of billing easier, consistent, and efficient. The guidelines and policies you set out for establishing your billing process are essential to ensure everyone is on the same page and that clients receive consistent invoices.

Law Firm Billing Best Practices

To create a clear billing system for your law firm, here are some law firm billing best practices that you can follow or adapt to your way of doing business:

- Establish clear billing terms. Your law firm’s billing terms should clearly outline the rules everyone involved in the billing process must follow to ensure compliance. This means ensuring that any outside legal counsel understands how to properly submit invoices using your firm's software, and/or follows the same billing structure that you use for services (e.g., flat fee billing for a service instead of billing by the hour).

- Use detailed invoices. While you don’t want your invoice to get too bogged down with fine print, it’s a good idea to make sure that it clearly outlines the legal services performed and a breakdown of charges. Detailed doesn’t have to mean a line-by-line itemized list of every single task, rather it should accurately capture the total scope of the project in an easy-to-read format.

- Make sure invoices are submitted in a timely manner. Timely invoice submission is essential not just for staying on top of your budget and accruals, but also for keeping your books as up-to-date as possible. Set out expectations on invoice submissions (e.g. every week or month), when you expect payment (e.g. within 60 days), what penalties there will be for late payments (e.g. a 15% fee for payments received after 60 days), and what options clients have to pay their invoice (e.g. online, by check, money order, etc.)

- Set out a clear invoice review process. Invoices may need to be reviewed before they are sent out for accuracy. For instance, if your law firm uses a standardized coding system such as LEDES, ensure that every code a lawyer uses in their invoice aligns with the work performed. In many cases, if the law firm uses LEDES codes, the process of reviewing invoices can be automated through software, namely a matter management system. Obviously, this would be done before a client is billed.

- Outline how resolutions should be handled. If discrepancies appear in any step of the billing process, there should be a policy in place that outlines how these discrepancies will be handled. This may mean client involvement or the involvement of a more senior legal professional at the firm in some cases, but the important thing is to set up a process where inaccuracies can be caught early and reconciled in as little time as possible. However, upfront pricing with AFAs rarely result in the need to revisit a bill with clients, as the pricing has already been agreed upon before the work started.

Law Firm Billing Procedures to Improve Collection Rates

One of the major ways that law firms and lawyers can streamline their billing process is by investing in effective billing software. But this software shouldn’t just provide another way to create invoices, it should integrate seamlessly with your firm’s tech stack and billing policy.

As your law firm builds its billing policy, you’ll need to outline a step-by-step procedure for executing each bill. Law firm billing procedures vary widely depending on the services offered, individual clients, and how they reconcile time with tasks completed.

Regardless of how your law firm bills clients, your procedure should follow the billing guidelines and policies you set out in advance and follow the goal of getting paid by clients faster and easier.

With this in mind, we've outlined some steps that you can follow to create an effective billing procedure for your law firm:

- Track time or services effectively. Whether you’re using alternative billing methods beyond the billable hour or are still tracking time for each task, having an itemized list of what you’re billing the client for is the first step in crafting a final bill. Most law firms already use law firm billing software to handle this, so it should be fairly easy to keep your billable items straight for each client. LEDES and UTBMS codes are especially helpful here for keeping billable tasks clear and organized in an electronic system.

- Use an invoice template. Having an invoice template ready to modify as needed is not only a big time-saver, but it also helps ensure consistency.

- Create a timeline for when bills are to be sent. At the start of any attorney-client relationship, a clear timeline should be established that outlines when invoices are to be sent out, and, subsequently, the date they should be paid. This tells the client when they should expect to receive an invoice, and also sets them up to pay sooner rather than later.

Law Firm Billing Process

The law firm billing process is the result of your law firm’s billing guidelines, policies, and procedures coming together to create step-by-step instructions on how to execute each bill.

While not specific to the legal industry, the order to cash cycle is a straightforward billing process that any business can follow, including law firms. The process described below has been modified to reflect the typical billing process that a law firm would follow if they use this process:

- A client seeks legal services through your law firm, and a lawyer documents what they need to be accomplished. The lawyer also sets out expectations with regard to how the legal service will be handled, when and how the client will be updated throughout the proceedings, when the client will be billed, and how, and more, with an agreement.

- The lawyer gathers information and resources and conducts research to start handling the legal matter. Throughout this process, they also update the client on any changes to the scope of the initial project, if applicable, as this may change how the client is billed.

- The lawyer handles the legal matter.

- An invoice is created and sent to the client.

- The client pays their invoice according to the terms set out in the agreement.

- The payment is recorded in the law firm’s books.

Factors to Consider When Choosing Software for Law Firm Billing

Choosing a solution from the myriad of law firm billing software options on the market can be daunting. Following these recommendations can help you make a solid choice:

Choose Software with a Good Balance of Features Versus Price

Think about what your lawyers need in billing software, and make a list. Chances are you’ll come up with things like invoice templates, the ability to integrate with legal practice management software and pricing software, and online payment options for clients. Once you’ve created your list, create a list of legal billing software using websites like G2 or Software Advice. These websites can help you compare the features and prices of different products that match what you’re looking for. From there, you can get a baseline for what the software you’d like to purchase should cost.

Compliance with Local and State/Provincial Laws for Data Storage

When you’re using cloud-based software at your law firm, it’s important to double-check how the software stores sensitive data. Different jurisdictions have rules surrounding data storage for sensitive information.

In Canada, storage of sensitive data like client financial information must follow PIPEDA. In addition, the law firm must follow the rules set out by their provincial or territorial law society. As an example, in British Columbia, the law firm must inform their client if their data will be stored outside of Canada, and obtain the client’s consent.

In the USA, the firm must follow their state bar association’s guidelines on data storage. In Connecticut, for example, lawyers are expected to take reasonable data security precautions to ensure that their client’s data is secure, including segregating client and lawyer data to prevent unauthorized access, including by the cloud provider.

Reputation and Reviews

Ask other lawyers and legal professionals in your network about the law firm billing software that you’ve short listed. Have they heard of it? Do they have an opinion about it? This information can help you determine whether you should move forward with it. You can also read reviews online, and browse the vendor’s social media channels and website. If they keep things up-to-date and professional and have clear information about their product’s unique selling point, chances are it’s worth investigating further with a free trial or demo.

3 Law Firm Billing Solutions

We hinted at a few legal billing solutions in the last section, but let’s go into more detail about how these solutions can actually make a difference in your law firm’s billing process.

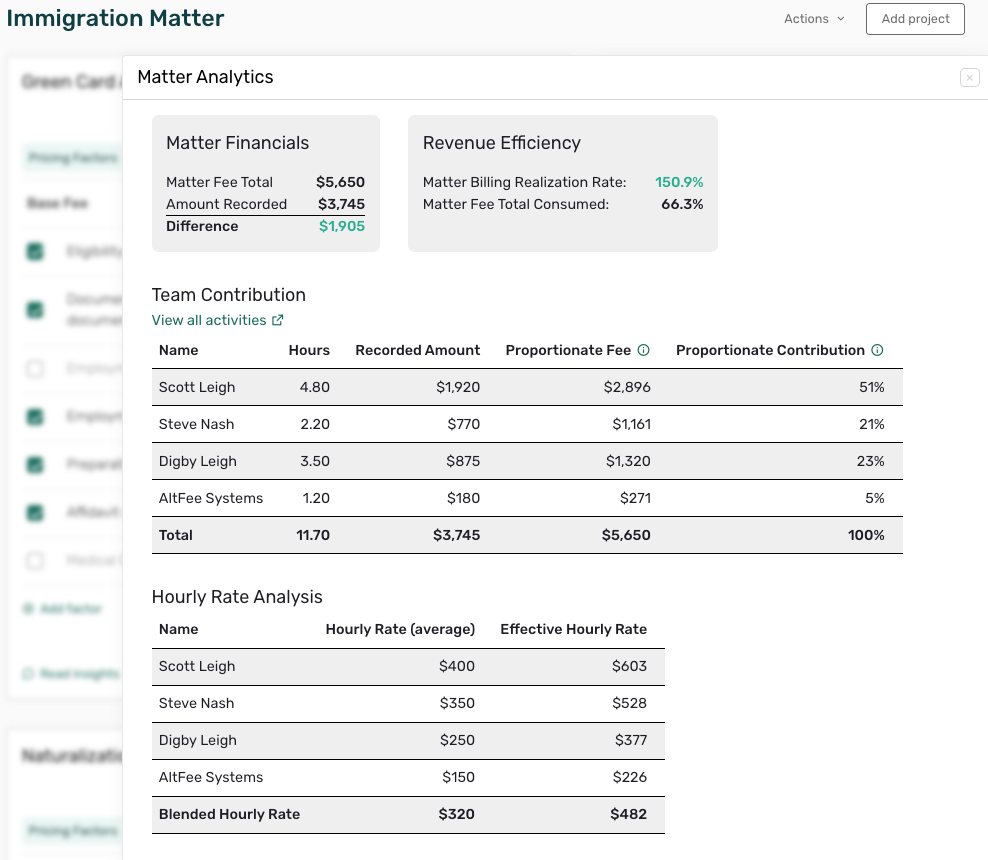

1. Alternative Fee Arrangements Software

AltFee is software that was built from the ground up by lawyers to help you manage your alternative fee arrangement types. Through a comprehensive, collaborative-focused approach, the tool helps you create, manage, and adjust your pricing for each and every matter and customize them for each and every client. Once you have pricing established upfront for each client matter, it’ll be much easier to bill them for it when the time comes.

2. Law Firm Billing Software

Once you have your pricing figured out, you can use billing software to greatly streamline your billing process. Automations can create client invoices at the click of a button or reconcile trust accounts before they are sent to the accountant. Law firm billing software can also allow you to accept payments and easily create consistent invoices.

3. Time Management Software

Just because you’re using alternative fee arrangements doesn’t necessarily mean your law firm isn’t tracking time at all, so time-tracking software is still an option. Alternatively, if you’re still using the hourly billing model, then good time-tracking software is essential. Some matter management software comes with built-in time tracking (PCLaw is one example) but other options can be used, such as Harvest. Even staff that don’t handle clients should consider tracking their time to ensure efficiency with the law firm’s operations. Effective time tracking also helps you see where the biggest time sucks in your law firm exist, so you can address them accordingly.

Conclusion

Effective law firm billing takes time and careful planning and consideration to get right. Being able to effectively reconcile the time it takes to handle a legal matter, project, or case, and translate that work into a final bill that you can confidently present to the client has been a contention point for lawyers for decades.

Modern ways to handle pricing, like alternative fee arrangements, are working overtime to shake up the law firm billing game. The billable hour is no longer an effective way to charge clients, as they are increasingly demanding price certainty and transparency with billing.

You are committed to your clients and want to showcase that commitment to them in every aspect of your relationship, including the billing process. That means being able to provide clear and value-driven pricing for legal services from the beginning. If you already use alternative fee arrangements or are thinking about switching to them, then you’ll need software to effectively manage them.

AltFee helps you not only set out pricing but also provides a platform where you can collaborate with other legal professionals on that pricing in one place. Interested in learning more? Get a demo today!

Start Earning More Revenue with Fixed Fees

Break free from hourly pricing and take the fear out of scoping and pricing client projects to start maximizing profitability.

Book A Demo

Newsletter Signup

Subscribe to our newsletter to receive the latest news.