- Resources

- Estate Planning Software: A Comprehensive Guide

Table of Contents

One major task that legal firms handle is helping with estate planning. Estate planning is important in helping clients set out their wishes regarding their assets and property for when they pass away or become incapacitated. Of course, estate planning involves dealing with sensitive information and ensuring the clarity and conciseness of documents so that the probate process can be handled in the most straightforward manner.

Estate planning software supports the planning process from start to finish and leads to better outcomes for the client and the attorney.

In this guide, we’ll go over the benefits of estate planning software as well as talk about what to look for when choosing one. We’ll also list some of the best estate planning software on the market that law firms can implement.

Attorney Estate Planning Software Options

Estate planning software supports law firms in assisting clients in planning for the event of their death or incapacitation. This includes preserving and protecting their assets, ensuring minor children’s desired custodial arrangements, and limiting taxes.

Estate planning software serves as a centralized platform where you can collect and track the documents and information you need about the following:

- Power of Attorney

- Trusts

- Probate

- Wills

Additionally, estate planning software can speed up the following processes:

- Creating a Will, Power of Attorney, and other estate planning documents

- Settling estate taxes

- Naming beneficiaries and executors

- Setting up trusts

- Planning charitable donations

Attorneys utilizing estate planning software can expect their work to be more accurate and completed at a faster rate. The software can also help attorneys streamline their goals for the day so everything is more organized.

Moreover, estate planning tools should provide innovative features, such as templates for common estate planning documents and convenient intake forms.

Benefits of Estate Planning Software for Attorneys

In a nutshell, estate planning helps legal professionals create basic or complex estate plans to meet their client’s needs faster and easier compared to manual processes.

The table summarizes the main benefits of acquiring estate planning software:

|

Benefit |

Purpose |

|

Automated Processes |

Speeds up everything because the software handles typical estate planning processes digitally and can automate certain tasks (e.g., document creation, filling in client information, etc.) |

|

Intuitive Legal Technology |

Many estate planning software offerings have intuitive features such as client-friendly documents (e.g., Beyond Counsel’s software translates documents into first-person language), the ability to quickly make changes as per client needs, perform spelling and grammar checks, and more. |

|

Meeting Client Demands |

Documents are drafted based on the client’s preferences. This means they are customized depending on what your client needs and expects. |

|

Security |

Helps protect sensitive information necessary for estate planning with features such as a secure intake portal. |

|

Cost-Effectiveness |

Estate planning software can streamline the document creation process, resulting in fewer overall costs for the firm and client. |

|

Simplification of the Process |

The process is simplified to allow your clients to better understand how estate planning works. |

Automated Processes

To help avoid the plague of human error, estate planning software is able to autofill client details and boilerplate document terms, ensuring complete document accuracy every single time. Further, these automations save time, as the attorney doesn’t have to manually enter client information or search for a term to copy/paste into the relevant document.

What’s more, attorney estate planning software ensures all files and related documents are easily accessible from a centralized digital platform.

This improves the overall efficiency of the planning process. It also allows attorneys to spend much more valuable time with their clients, which helps improve attorney client relations.

Intuitive Legal Technology

Now that most businesses are turning digital, the legal industry has also embraced online technology. A 2022 survey revealed that legal technology is driving greater resilience, improved client relations, and higher performance across law firms.

Estate planning isn’t excused from this, either. One way that using estate planning software can help produce better client relations and higher performance is that it allows attorneys to collect e-signatures for their documents. As a result, it becomes easier for lawyers to get authorization from clients and for clients to sign necessary documents.

Despite this benefit, remember that in many jurisdictions, estate planning is one of the legal practice areas that still requires documents to be signed in front of a lawyer. So, even though e-signatures are possible in some situations, there may still be a need to schedule additional meetings with clients in order to stay compliant with regulations and local laws.

An intuitive estate planning software solution should also integrate with the firm’s scheduling software of choice so that attorneys and clients remain up-to-date with upcoming appointments and deadlines.

Meeting Client Demands

Client expectations have shifted when it comes to how they expect to interact with their attorney. One of these shifts is a preference toward technology, like using video conferencing for face-to-face interactions over in-person. According to the 2021 Legal Trends Report from Clio, more than half of clients prefer tech-enabled interactions over in-person across all touchpoints during the attorney-client relationship.

This means that even during an important process like estate planning, clients expect the attorney to use software to interact with them.

With the help of estate planning software, estate planning documents are easier to draft and can easily be changed later on as the client experiences major life events (e.g., marriage, adoption, house purchase, etc.) that make it necessary to alter these documents.

Further, many attorney estate planning software offerings allow instant access online, making it easy for attorneys to access client documents on the go. Further, interactive features such as eState Planner’s interactive Will planning facilitate easy collaboration between attorney and client as the document is built out.

When clients are able to see their assets and finances displayed in an easy-to-read way, it reduces confusion and feelings of being overwhelmed and instead shifts the focus to the task at hand, which is ensuring their wishes are properly documented.

Security

Estate planning involves a client’s sensitive information that should be confidential at all costs. Leaking this data can be devastating both to the client and the attorney. Typical estate planning information can include the following personal details that should not be compromised:

- Family relationships

- Medical history

- Logbooks and title deeds

- Financial assets and records

One of the main ways that estate planning software keeps client information secure is through security features such as data encryption (while it’s moving and at rest) as well as built-in enterprise threat detection. These typical security technologies ensure that client information remains safe while still allowing attorneys the convenience of instant document access through the cloud.

Cost-Effectiveness

Estate planning software reduces mistakes and possible errors, which not only saves time, it contributes to reducing overall costs for your firm.

One way that these types of software can help save time and money for firms is by streamlining the intake process. Estate planning software allows clients to submit and sign documents through a secure portal, reducing the need to come into the office and meet physically with lawyers.

That can help reduce time spent working on a particular client and can also reduce the costs associated with in-person meetings.

Simplification of the Process

The entire process of estate planning is simplified thanks to efficient estate planning software. These legal software solutions are designed to be simple enough to be used and managed by attorneys, assistants, or other legal professionals.

One way estate planning software can simplify processes for attorneys is by allowing automated template generation. These templates are either included in the estate planning software as default documents or created by attorneys themselves. Using a template as a starting point rather than drafting a new document from scratch every time is a huge time savings in and of itself, but combined with the ability to drop in boilerplate terms and autofill client details further contributes to administrative time savings.

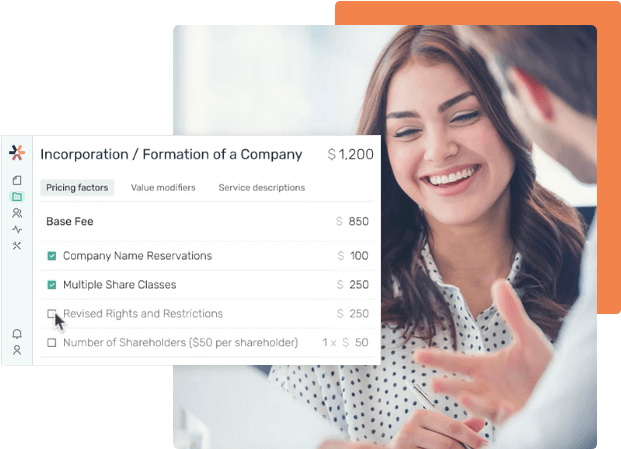

Start Earning More Revenue with Fixed Fees

Break free from hourly pricing and take the fear out of scoping and pricing client projects to start maximizing profitability.

Book A Demo

What to Look for When Considering Estate Lawyer Software

When looking for estate planning software, it’s a must that you consider the following questions. These questions will help you identify what’s suitable for your needs while also meeting your client’s expectations:

Is it Secure?

Regardless of your objectives, your top priority should be your law firm data security. That’s because you’re handling your clients’ important, sensitive information.

Before selecting an estate planning software solution, make sure to look at the security standards. Ensure that they are up-to-date according to the recent compliance set by the government and other regulatory bodies in your area. It’s also best that the software you choose follows your area’s regulations on data storage.

Different governing bodies have different regulations for what type of data storage firms must have and how secure it needs to be. This information can be found via your province’s law society (Canada) or your state’s Bar Association (United States). Look into these regulations in your locality and compare them with your chosen estate planning software. Doing so can help ensure that you’re not missing any points that could get your firm in trouble later down the line.

Also, remember that when you subscribe to unsafe software with no clear security guidelines, leaking sensitive information can destroy the hard-earned trust you’ve built with your client, not to mention serious repercussions with your law society; data breaches can also lead to significant monetary loss for your firm, including fines and even the potential for your firm to be shut down due to non-compliance.

Will It Make Your Job Easier?

Different estate planning software offers different benefits that can help simplify processes for legal teams.

For instance, some software allows for electronic signature capture. This can reduce the number of in-person meetings required and speed up the time it takes to get client authorization.

Another popular feature of attorney estate planning software is secure online intake forms. Since everyone is using the internet to find services these days, whether through word of mouth via social media or a quick search on Google, having a way to streamline client intake via your firm’s website is paramount. With a secure intake form facilitated by estate planning software, an attorney gets the information they need to proceed with the client’s case, eliminating the need for a lengthy discovery phone call.

It’s important that when selecting estate planning software, you match features to solutions and think about how these features can make your job easier and more effective.

Does it Have Reliable Customer Support?

It’s possible to experience technical issues with any software. That’s why it’s important to find a software vendor that can provide reliable customer support, so you can continue providing clients with dependable service.

This is also important for ensuring that your team understands how to navigate the software. When you’re initially setting up an estate planning software in your firm, choosing software that has a solid onboarding process makes the implementation process easier.

Best Estate Planning Software for Lawyers

A good estate planning software for lawyers should offer reliable customer support, promote effective time management, and simplify processes. Out of the many estate planning software options available, a few that meet these criteria and offer additional benefits to firms include:

- Clio

- MyCase

- Amicus Attorney

- Beyond Channel

- CounselPro

Here’s a deeper look at each of these software types and their pros and cons.

Clio

One system that offers great estate planning software is Clio It’s a web-based legal practice management software that promotes better streamlining of workload for improved efficiency and productivity. However, it also offers specific estate planning services.

With Clio, you can replace multiple systems into one system that enables the simultaneous performance of various operations. A few key aspects of their estate planning services include:

- Standardizing information collection

- Connecting with other estate planning software, such as WealthCounsel

- Keeping documents organized

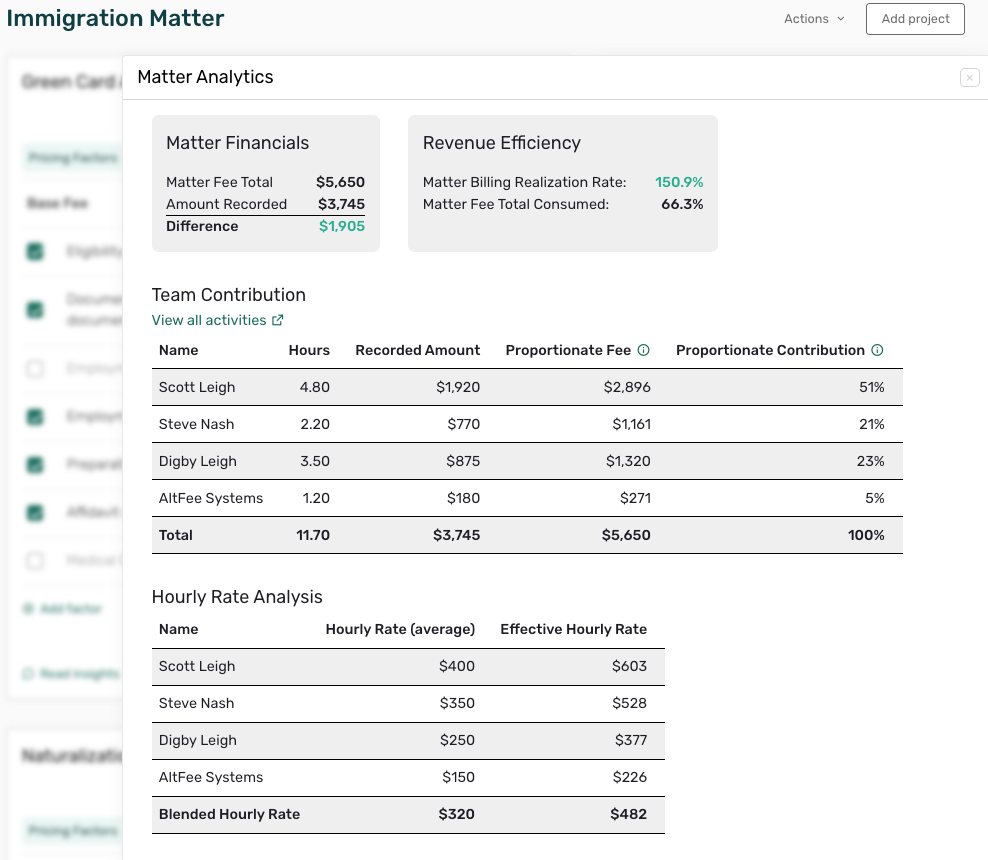

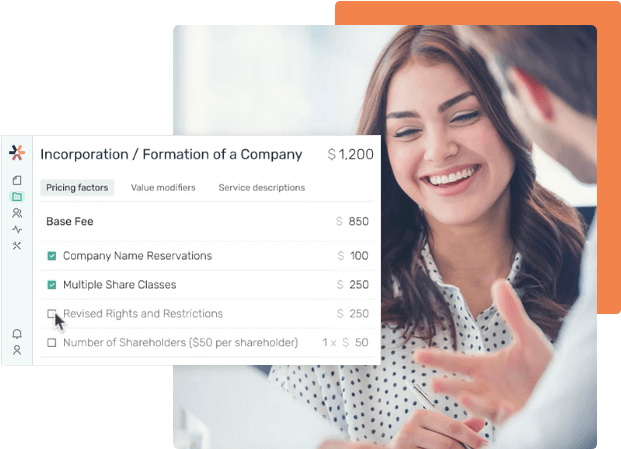

Clio also has an impressive integration library, including pricing software like AltFee.

Start Earning More Revenue with Fixed Fees

Break free from hourly pricing and take the fear out of scoping and pricing client projects to start maximizing profitability.

Book A Demo

Pros

- User-friendly interface

- Easy transmission of all your clients into the software

- Big app integration library available.

- Promotes easy billing cycles because of payment, invoicing, and billing integration

Cons

- Document management has a bit of a learning curve

- Budgeting, and case management could be improved in their standalone offering

MyCase

Another option for small firms and solo practitioners is MyCase. It’s an all-in-one estate planning software that promotes security and efficiency in case management. MyCase can alleviate high caseloads and poor client communication, ensuring outstanding estate planning operations.

One key feature of MyCase is its centralized document storage system. This allows legal teams to collect and store client documents throughout the estate planning process. The system keeps documents secure and organized in one location so that it’s easy for attorneys to access them when they need.

Pros

- Effective accounting leads to reduced errors and consequences

- Better client management

- Scheduling is improved, reducing the risk of missing appointments

Cons

- Workflow can still be improved

- Integrations are not simple to implement

Amicus Attorney

A legal practice management solution on the cloud and on-site is Amicus Attorney. This estate plan software streamlines case lifecycles—from document creation to invoice raising for clients.

This software simplifies the estate planning process through automation, which helps reduce errors and improve accuracy. On top of that, it can be integrated with calendars to ensure that attorneys have client files ready to go at the right time.

Pros

- Efficient calendaring

- Keeps all contacts, documents, and emails in a single place

- Allows automation of documents with ease

Cons

- No partner channel available

- Poor product support

Beyond Counsel

Beyond Counsel has been in the estate planning industry for more than 15 years. It has served more than 100,000 clients and produced at least a million documents.

One unique feature of this software is the subscription models at different levels. These subscriptions increase value or price with every level included. Beyond Counsel’s estate plan software involves workflow management and estate plan drafting, and legal education.

What sets Beyond Counsel apart is its ability to ensure automated workflow to speed up estate planning processes. It also allows automated scheduling.

Pros

- Quick automation of document scheduling and calendaring

- Established reputation

- Save time and cost

Cons

- Subscriptions get more expensive as you increase your level

CounselPro

CounselPro is an estate planning software built on Actionstep. Estate planning experts designed this software, which is maintained and checked by the Academy’s technology and education departments.

CounselPro allows easy work planning, ensuring clients get the service they deserve. It features end-to-end solutions to provide you with all the tools you need for your clients. A few features of CounselPro include:

- Document assembly is fully automated to simplify estate plans

- Complete client information management, which also includes asset inventories

- Effective client communication tools to create automated reminders and updates

- Easy seminar management because of its marketing optimization tools

- Office workflow management to prevent bottlenecks

- Appointment scheduling tools, including quick monitoring of schedule changes and cancellations

All of these features make it easy for firms to use in order to assist clients with estate planning.

Pros

- Intuitive interface

- Complete tools to make your lives easier

- Reduced time in managing client information because of a multitude of client-based tools

Cons

- Some features might require a learning curve

- It’s more expensive than other estate planning software

How to Implement Cloud-Based Estate Planning Software

Cloud-based estate planning software ensures all aspects of estate planning are kept in one place.

If you’re looking for effective ways to implement cloud-based estate planning software for your law firm, you need to think about several considerations. For instance, you’ll need to think about your integration and development approach.

Various estate planning software also has different approaches to integration and development. It’s either an out-of-the-box solution (often SaaS) or customized. Customized solutions are far more tailored to your specific demands, while SaaS law technology is generally cheaper.

You’ll need to choose which makes the most sense, financially and process-wise, for your firm. From there, you can make a selection and implement the best system for your needs.

Additionally, legal teams will need to take several steps in order to ensure that their software is ready to launch for clients. The below table outlines some of these steps and why they matter.

|

Step |

Why It Matters |

|

Current tech stack integrations |

Not all cloud-based systems integrate easily with the software that legal teams have in place. Before implementing a new cloud-based estate planning software, legal teams need to look into how it will integrate with current systems. This can help make sure that there are no technological delays or hiccups when they try to hit the ground running with the new solution. |

|

Implement team training |

As with any new software, implementing a cloud-based estate planning software involves getting team members up to speed on how it works. Legal teams will need to ensure everyone accessing and using the new software understands how to use it by conducting training sessions before the full implementation. |

|

Creating estate planning document templates |

To streamline document creation and take full advantage of the software's automations, custom document templates should be created in advance. |

|

Creating intake forms |

Before launching a new cloud-based estate planning software, lawyers should create client intake forms. These can then be uploaded into the software so that they’re easily accessed, edited, and distributed to clients by team members. |

Conclusion

Estate planning software simplifies the process of helping clients create their final will and testament. They make it easier to meet client demands, manage internal processes, and automate steps so that you can accomplish tasks faster and with improved accuracy.

When looking for estate planning software, seek out systems with good security and reliable customer support. Doing so will enable your business to implement new technology seamlessly without compromising sensitive documents.

As you offer estate planning services to your clients, ensure that you have a proper pricing system in place to accurately capture and articulate the value you are able to deliver. Contact AltFee today to get a demo of our pricing software for legal teams that support proper estate planning service pricing for your clients.

Start Earning More Revenue with Fixed Fees

Break free from hourly pricing and take the fear out of scoping and pricing client projects to start maximizing profitability.

Book A Demo

Newsletter Signup

Subscribe to our newsletter to receive the latest news.