- Resources

- Top 5 Legal Accounting Software for Modern Law Firms

Table of Contents

Imagining what it was like managing a law firm’s finances before legal accounting software was available conjures up pictures of…paper.

Stacks. Of. Paper.

Files. Boxes of them.

Manilla folders.

Thankfully, these days, endless files and folders are less common because of advancements in legal technology, including law firm accounting software. Complex bookkeeping and accounting can be handled digitally, freeing up time and saving money by having more efficient processes for handling finances.

But legal accounting programs are not all built equally. Before you purchase the first one that shows up in a google search, you should be aware of what you need it to do, and what the different software offerings out there can provide.

Let’s open the book on law firm accounting software and what it can do for you, and finish off with some software recommendations that are sure to make managing your law firm’s finances easier and more efficient.

What is Law Firm Accounting Software

While AltFee offers alternative fee arrangement software to help you set out the pricing structure that your law firm will follow, you’ll need something to handle the accounting side of things. Oftentimes, traditional accounting software like Quickbooks by itself doesn’t cut it.

Law firms often have more complex accounting needs when compared to other businesses. There are often many moving parts when it comes to keeping track of finances, for instance with advanced fee deposits and retainers from clients. Law firm accounting software makes it easier to manage your law firm’s accounting to ensure you’re meeting regulatory and ethics requirements.

An accounting software for law firm can include more specific features that are not included in other typical offerings, including time tracking, trust or IOLTA accounting management, matter reporting, and practice management.

Legal Accounting Software vs. Bookkeeping Software for Lawyers

It’s no secret that law firm accounting is more difficult and nuanced than the typical money management of other types of businesses. And, believe it or not, most lawyers didn’t go to school to learn about bookkeeping and accounting, they went to learn about the law.

At the same time, every business needs accounting, and law firms are no different. So whether you own your own law firm or work at one, knowing the basics of accounting is paramount to ensure you follow all ethics and regulatory requirements surrounding money handling and management.

But what exactly is the difference between bookkeeping and accounting for law firms?

- Bookkeeping refers to the administrative side of things — recording legal financial transactions in the Original Books of Entry (sometimes called Records of Original Entry) so that the information can be posted to the relevant subsidiary ledgers (e.g. disbursement ledger, trust ledger, and general ledger). These books include all the original financial information from credit card receipts, invoices, lawyer’s bills, etc. In short, bookkeepers provide accountants with the information they need.

- Accounting handles taxes, analyses your law firm’s cash flow, and gives you a numbers-don’t-lie understanding of the profitability of your business. Using this information, you can make informed decisions about the future of your business.

Here’s a quick breakdown of the tasks for each:

|

Legal Bookkeeping Tasks |

Legal Accounting Tasks |

|

Record financial transactions, including payments and expenses |

Provide advice to the law firm owner with regards to financial decision making |

|

Balance financial accounts |

Prepare financial statements and manage financial information, as well as separate profits from income |

|

Perform bank reconciliation |

Complete tax returns |

|

Create invoices |

Prepare to adjust entries |

|

Handle payroll |

Perform audits |

|

Prepare books for the accountant |

Handle client trust and case cost accounting |

Legal Accounting and Bookkeeping

Although legal accounting and bookkeeping are two separate tasks that could be performed by two different professionals, most legal accounting programs include functionality that handles both. This makes sense because the two work closely together (and realistically an accountant could handle both tasks) but it can cause confusion for those newer to law firm accounting.

If you’re looking for software that can competently handle both bookkeeping and accounting, you’ll need to pay close attention to the features that it includes. Some accounting software includes some bookkeeping functionality, but not everything that you need, and some offer complete bookkeeping and accounting features. Before you purchase software, it’s important to make sure that it will do what you expect. We’ll get into recommendations for the best law firm accounting software choices later in this article.

Challenges of Legal Accounting

Because of its complexity, legal accounting can be challenging to get right, especially for smaller law firms and solo practitioners. Being aware of the challenges beforehand and having the knowledge behind how to avoid legal accounting issues helps set you up for success.

Client Trust Fund Accounting

Managing client trust accounts seems easy; all you have to do is keep client money separate from that of your law firm. But for smaller law firms or solo practitioners, navigating the intricacies of banking systems while at the same time following regulatory rules with client trust fund accounting can be difficult.

Client trust accounts can be pooled (more than one client’s money in an account) or separate (usually for larger sums of money or if requested by the client). Every jurisdiction also has different rules surrounding trust fund accounts as well, where you may require only one or multiple pooled accounts for different legal services. If you neglect any aspect of your trust account(s), you may be putting your law firm at significant financial risk or even lose the ability to practice altogether.

Some common challenges law firms face with trust fund accounting are:

Handling Unclaimed Client Funds

The first and most obvious solution for unclaimed funds is to make every reasonable attempt to contact the client. In Canada, the Legal Profession Act states that a law firm has to hold client funds for more than two years and make every effort to contact the client about their funds. If they are unable to get ahold of the client, then the law firm must forward the unclaimed funds to the province’s law society.

American states follow a similar process for unclaimed funds, with each state’s bar association setting the rules and regulations surrounding the length of time funds must be held, and what to do with those funds if they remain unclaimed. For instance, in Ohio, funds must be held for at least five years, and after that time they must be donated to a legal assistance foundation that increases access to justice.

Employee Theft

Unfortunately, employee theft can be a problem for law firms in general, with mishandling of client trust accounts being one of the many ways an unlawful employee can sap funds from a practice. The best way to prevent employee theft in general, and with regards to client trust accounts, is to ensure accurate and detailed financial reporting, with accountability in place. In other words, If one person is solely responsible for all financial reporting, including bookkeeping, it’s easier for them to hide fraudulent activity. If a major stakeholder in the firm (like the owner) takes the time to review financials and understand exactly where money is going, then at least theft can be caught early or prevented entirely (because more oversight is a deterrent for the theft occurring in the first place).

Inaccurate Trust Reconciliation

Managing client funds is obviously more nerve-racking than managing your own, as the money isn’t yours. It’s all the more reason to ensure that you’re keeping accurate financial records.

Responsible trust account reconciliation is part of keeping accurate financial records, even if the trust account has no balance. There are many reasons why your records may not match the bank’s, including processing errors, service fees charged, or posting errors. This is why bank reconciliation is done in the first place because discrepancies are so common.

Using software with automations is one of the ways that you can help eliminate human error from being a cause of discrepancies. Plus, it keeps all the information you need in one place, including invoicing, individual client ledgers, bank statements, money movement, and reporting — you name it. In fact, many law firm and accounting management software solutions even do automatic three-way reconciliation to target discrepancies early so they can be fixed as soon as possible.

Matter-Centric Billing

Ensuring that costs are accurately billed to the client may seem easy, but it can actually be quite complex depending on how you handle billing in general. Costs must be tied to the correct matter, and client payments must be separated from fee reimbursements.

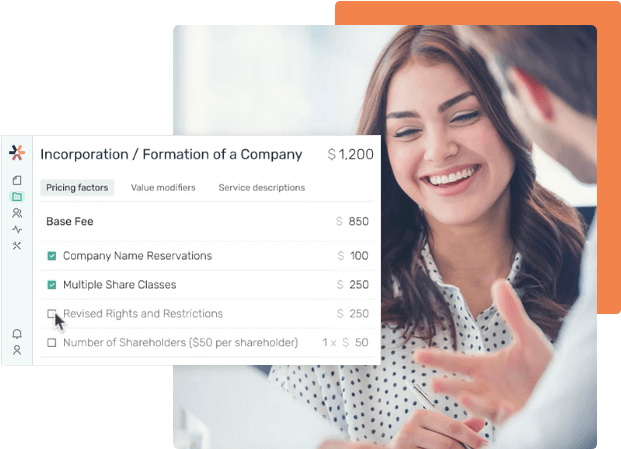

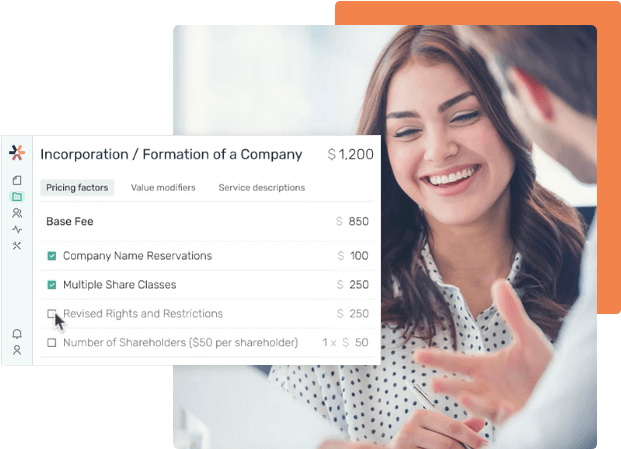

Having clear fee structures through alternative fee arrangements is one easy way to ensure the accuracy of matter-centric billing, as fees are set out in the beginning rather than being estimated like with hourly billing.

That being said, accounting software for lawyers can accurately keep billing for different matters straight, but it needs to be backed up by a clear billing process. Having a clear billing process (including how clients can pay, when bills are sent out, consequences for late payments, and more) in place keeps things focused and straightforward, and having a review process that includes multiple stakeholders makes managing and ensuring the accuracy of bills easier.

Differentiating Income and Revenue

Costs incurred from a legal matter must be handled by the money that a client pays via an invoice, full stop. If a law firm mingles client payments with revenue, then records will be off and they could face compliance issues.

Accounting software for lawyers can easily separate income and revenue by keeping a client’s legal matter and their invoice payment connected, meaning that actual revenue will always be listed separately.

Data Entry Errors

It’s super easy for data entry errors to happen, but when they do, it costs time and money. Automations made possible by accounting software for lawyers ensure that these errors are eliminated or minimized, keeping the law firm compliant and helping to ensure that money isn’t wasted fixing unnecessary errors.

Compensation Reporting

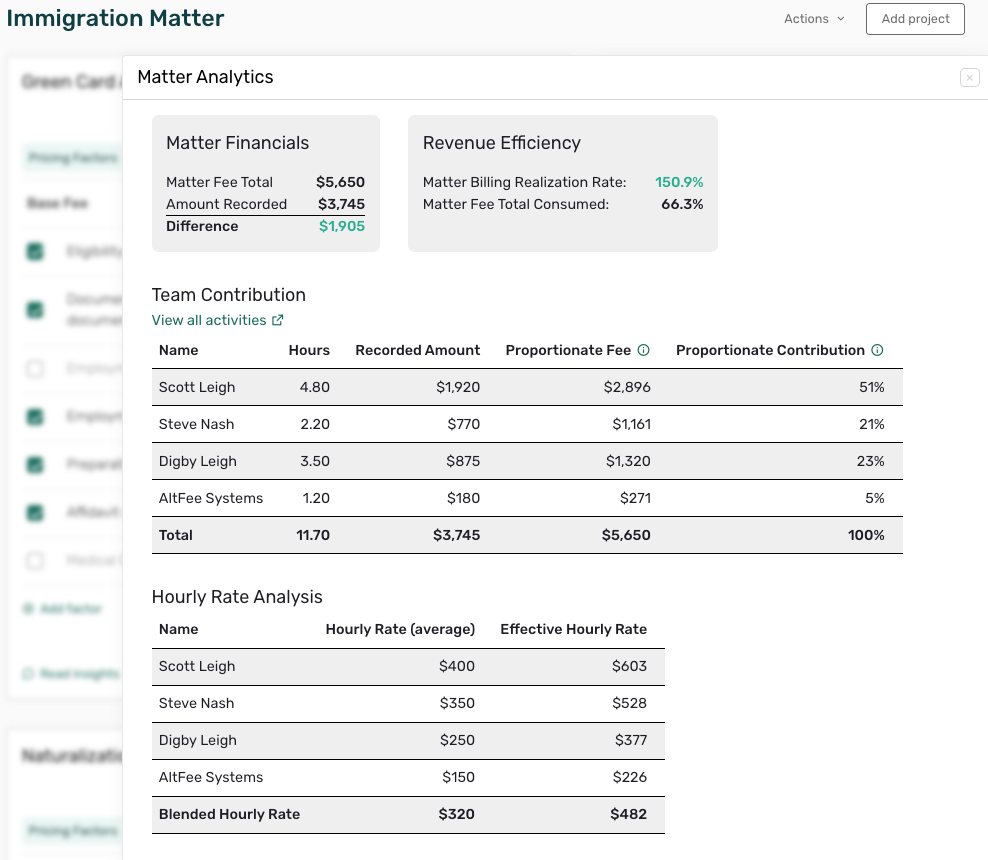

If all the other components of your law firm’s billing and financial reporting don’t fall into place, it can cause difficulties in ensuring that the right lawyer gets compensated fairly for their work. This can be tough with all the different components involved with how a lawyer or legal professional should be compensated, especially if you use the billable hour where time presents an extra layer of complexity.

This is why it’s important to keep accurate records and separate cases or matters based on the attorney. The best legal accounting software will be able to aggregate every financial component of a legal matter or case, including originally set out fee structures or billable hours, receipts, payments, etc., and provide an organized way to divide out compensation to billable staff.

5 Best Law Firm Accounting Software

There are a ton of legal accounting software offerings available, but not all of them are created equal. One of the biggest differentiators between accounting software for lawyers versus general accounting software is the ability to handle statement reconciliation, trust accounting, and bank statements, alongside regular functionality like time tracking, billing, payroll, taxes, and more.

To be more specific, legal accounting programs can include:

- Matter management: the process in which the software handles all the activities surrounding legal work, including the collection, storage, and organization of data

- Time tracking: the ability to track time for a task and keep it tied to a specific legal matter

- Trust Accounting: keep track of client funds and what funds are owed to which client, plus the ability to perform a three-way reconciliation between the client trust account(s), ledgers, and bank statements

- Comprehensive billing system: the ability to track time and expenses appropriately based on the job and service rates and marry that together with individual employee time tracking and service codes, plus invoice creation

What you’ll notice about the majority of legal accounting program offerings out there is that the messaging surrounding these products still focus on increasing the efficiency of the billable hour. However, many of these offerings can still be tailored to work with a law firm that uses alternative fee arrangements, but it often means that specific software to manage your law firm pricing structure will need to be handled by a program like AltFee.

Start Earning More Revenue with Fixed Fees

Break free from hourly pricing and take the fear out of scoping and pricing client projects to start maximizing profitability.

Book A Demo

That being said, here are our recommendations based on the availability of these legal-specific features, plus things like ease of use, customer service, and comprehensiveness of bookkeeping and accounting features.

1. PCLaw

PCLaw is a great all-in-one legal accounting software solution that can handle bookkeeping and accounting for law firms large or small. All the necessary legal functionality that you could want is included here, such as matter management, billing, and client trust account management, plus the ability to save time and money with administrative tasks through automations. It even uses Legal Electronic Data Exchange (LEDES) codes to simplify billing.

However, the software has been known to be difficult to use overall (perhaps because of the robustness of features) and it also doesn’t offer integrated payroll processing, which makes translating the comprehensive time tracking and overall matter management into paying staff trickier than it should be.

2. LeanLaw

When it comes to the best accounting software for small law firms, LeanLaw is one of our top picks. It integrates with Quickbooks to provide the specific legal accounting needs that law firms need, including three-way reconciliation, easy timekeeping, invoicing, and mobile functionality for ease of access on the go. It’s also compatible with LEDES billing codes. You can also seek help with different aspects of your law firm, from trust accounting, workflow management, and more through LeanLaw’s partners.

3. TimeSolv

TimeSolv is both a bookkeeping and billing solution that integrates with standard programs such as QuickBooks, Xero, Microsoft 365, and Dropbox. It’s cloud-based software, but it backs up data securely with 256-bit SSL encryption (in non-techie speak, that means it’s very secure). It works for law firms of all sizes and even provides some project management features, like timekeeping.

4. CosmoLex

Cosmolex combines legal practice management software with legal accounting software for a complete solution. It’s actually completely cloud-based, so you don’t have to install it on a computer, rather it’s accessed online through a browser. Notable features include its time & expense capture, which helps you ensure that time is accurately recorded and expensed across legal matters, and legal billing and payments, which allow customized invoices and online payments.

5. Soluno

As a cloud-based legal accounting software solution for law firms of any size, Soluno offers case and contact management, time and expense tracking, trust accounting, billing, and more. It integrates with common law firm management tools like NetDocuments and Yocierge for increased functionality. It also provides detailed reporting for tax purposes.

Law Firm Accounting Software Comparison (Pros and Cons)

Still unsure as to which of the above software offerings is right for you? Here is a comparison of the pros and cons of each of the software offerings we described above, using sources from around the internet such as Capterra, Lawyerist, the websites of the products themselves, and other law firm accounting software reviews that we could find online.

PCLaw Pros and Cons

|

Pros |

Cons |

|

Very comprehensive offering positioned as an all-in-one legal accounting solution |

Can be difficult to use overall |

|

Robust trust accounting and matter management features |

No payroll processing |

|

Offers a secure client portal for document sharing, etc. |

No mobile access (except for the time tracking program) also no online payments |

LeanLaw Pros and Cons

|

Pros |

Cons |

|

Easy to use, isn’t bogged down with unnecessary features |

Requires Quickbooks to use and this integration can sometimes be difficult to navigate |

|

Is affordable compared to other legal accounting solutions |

Comprehensiveness of features can be lacking, for instance, it can’t manage matter docs, contacts, or communications |

|

Automatically reconciles trust accounts |

Inputting expenses can be confusing |

TimeSolv Pros and Cons

|

Pros |

Cons |

|

Integrates with software like QuickBooks and Xero |

Not as user-friendly when compared to other solutions |

|

Supports unlimited projects and clients |

Templates are not as comprehensive as they could be |

|

Affordable compared to other software offerings |

Accounting features are limited to the higher tier plans only |

CosmoLex Pros and Cons

|

Pros |

Cons |

|

Accepts online payments |

No integrated payroll system |

|

External accountant can log in for book management and more |

Software can be slow to load |

|

Built-in accounting software |

More expensive compared to other software offerings because of pay per user |

Soluno Pros and Cons

|

Pros |

Cons |

|

Browser based, so no need to install software |

Lack of customization with reports |

|

Easy switching if you’re using common software such as PCLaw or Clio |

User interface isn’t the easiest to use |

|

Lack of overall legal matter management features (aside from straight accounting) |

Doesn’t have built-in collaboration tools |

Conclusion

If you’re looking at law firm accounting and financial management software, it’s important to consider that the standard options out there, such as Quickbooks, may not be enough on their own. Ideally, you want legal accounting software that allows you to handle bookkeeping and accounting tasks together, to ensure that the information from both is considered in final reports.

In addition, the way that the software handles matter management, time tracking, trust accounting, and billing needs to work with your law firm’s current processes and workflows. While most legal accounting software does offer some level of trust account management, you should be sure that it can reconcile the account(s) to the level that you need depending on the jurisdiction of your law firm.

You’ll likely need software alongside your legal account solution to manage your law firm’s pricing. That’s where AltFee comes in. As a complete pricing tool that focuses on collaboration, AltFee makes it easy to create, manage, and analyze your law firm’s fee structures.

Get a demo today and learn how AltFee can make a difference in your law firm.

Start Earning More Revenue with Fixed Fees

Break free from hourly pricing and take the fear out of scoping and pricing client projects to start maximizing profitability.

Book A Demo

Newsletter Signup

Subscribe to our newsletter to receive the latest news.